Bitcoin has dropped back to the $60,000 level this week but Anthony Pompliano remains bullish as ever on the world’s largest cryptocurrency by market cap. Anthony Pompliano is the founder of Pomp Investments. Pompliano is bullish on both BTC and AI Pompliano continues to see Bitcoin as well as artificial intelligence as a “10-year trend”… Continue reading Pompliano touts Bitcoin and AI: here’s what it means for Bitbot

Market News

Just in: Morgan Stanley to greenlight Bitcoin ETFs for all clients across their platform

The latest Morgan Stanley’s crypto-related news triggered optimism in the digital assets space as Bitcoin struggles to escape the $60K vicinity to the upside. X updates reveal that the US-based banking giant will likely approve Bitcoin exchange-traded funds across their wealth management platform. JUST IN: 🇺🇸 Morgan Stanley expected to approve #Bitcoin ETFs on their… Continue reading Just in: Morgan Stanley to greenlight Bitcoin ETFs for all clients across their platform

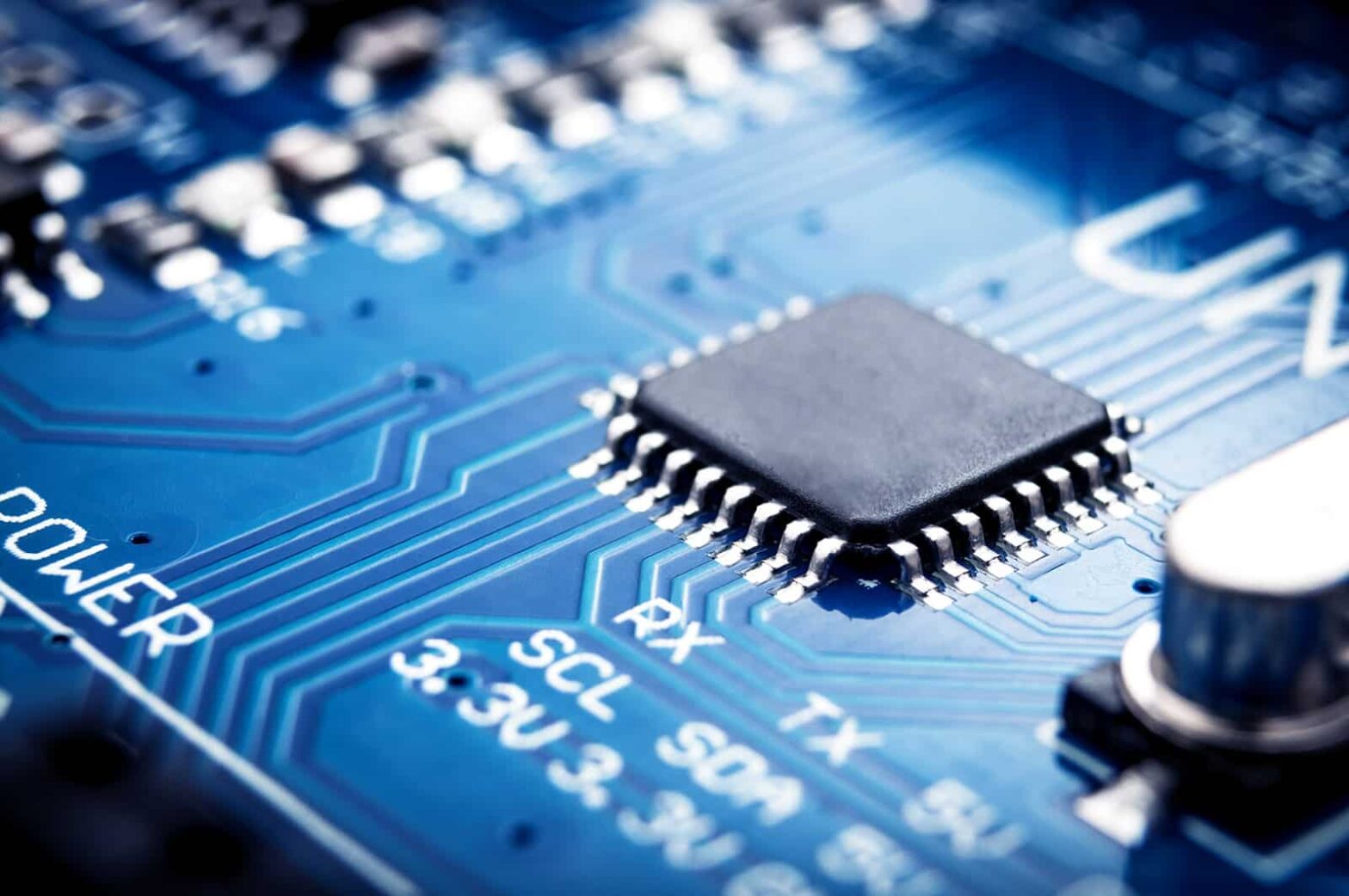

Semiconductor stocks volatile after Nvidia’s $500 billion wipeout

Global semiconductor stocks experienced volatile trading on Tuesday following a significant decline in Nvidia shares in the previous session. The fluctuations reflect investor reactions to Nvidia’s sharp drop in market capitalisation, impacting chip firms across Europe and Asia. Nvidia’s market value tumbles, then rebounds Shares of Nvidia fell sharply over three consecutive sessions, losing 13%… Continue reading Semiconductor stocks volatile after Nvidia’s $500 billion wipeout

Cloudflare stock price forecast: Can it hit $100 again?

Cloudflare Inc. (NYSE:NET) has been a standout in the tech sector, known for its robust cloud networking and cybersecurity services. As of today, the stock is trading flat year-to-date at around $80 but significantly down from its February peak of $116. This down move has created concerns among investors about its future trajectory. Recent developments… Continue reading Cloudflare stock price forecast: Can it hit $100 again?

What made Regis stock more than double on Tuesday?

Regis Corp (NASDAQ: RGS) has entered into a “new senior secured credit facility” with the global asset manager TCW Asset Management Company LLC and Midcap Financial Trust. Its shares are up well over 100% on Tuesday. Why does it matter for Regis stock? A $105 million term loan, the company’s press release added, will replace… Continue reading What made Regis stock more than double on Tuesday?

JustMarkets awarded best CFD broker, best IB/affiliate programme within UF Awards 2024

JustMarkets is an internationally trusted CFD broker that received two significant awards: Best IB/affiliate programme and Best CFD broker during iFX EXPO 2024 in Cyprus. iFX Expo International is one of the biggest events in the online finance world. Global brands, C-level professionals, startups, and fintech innovators gather to exchange experiences. More than 10,000 attendees… Continue reading JustMarkets awarded best CFD broker, best IB/affiliate programme within UF Awards 2024

ENSO secures $4.2M in funding

Zurich, Switzerland, June 25th, 2024, Chainwire ENSO, the world’s first intent engine powering chain abstraction, and intent-centric future, announced today the successful closure of a $4.2+ million funding round. The funds will be used for continued product development, with their L1 cosmos-based blockchain to be launched this year. The round had participation from Ideo Ventures,… Continue reading ENSO secures $4.2M in funding

India, China lead in Russian fuel oil and VGO imports in May

India and China emerged as the top destinations for Russian seaborne fuel oil and vacuum gasoil (VGO) exports in May. Traders and data from LSEG indicated a significant increase in these exports, reflecting shifts in global trade patterns following the European Union’s embargo on Russian oil products. Surge in Russian fuel oil and VGO exports… Continue reading India, China lead in Russian fuel oil and VGO imports in May

SolarEdge stock plunge: Bargain buy or falling knife?

SolarEdge Technologies (NASDAQ: SEDG) is making headlines today with two significant pieces of news that have sent shockwaves through the market. The company announced plans for a private placement of $300 million in convertible senior notes, which will mature in 2029. This move aims to fund capped call transactions, redeem part of their outstanding 0%… Continue reading SolarEdge stock plunge: Bargain buy or falling knife?