Shares of major private investment managers slid sharply on Thursday after Blue Owl Capital’s decision to permanently restrict investor withdrawals from one of its retail-focused debt funds reignited concerns about liquidity risks in the fast-growing private credit industry. The sell-off underscored investor unease that limits on redemptions could spread to other private credit vehicles, particularly… Continue reading Why did private credit stocks slide, and what’s up at Blue Owl?

Featured Stocks

Steve Cohen leads hedge fund rich list with $3.4B payday

Steve Cohen, owner of the New York Mets and founder of Point72 Asset Management, earned $3.4 billion in 2025, making him the world’s highest-paid hedge fund manager, according to Bloomberg. The figure translates to more than $9 million per day. It comes during a difficult period for Cohen’s baseball team, which struggled through the 2025… Continue reading Steve Cohen leads hedge fund rich list with $3.4B payday

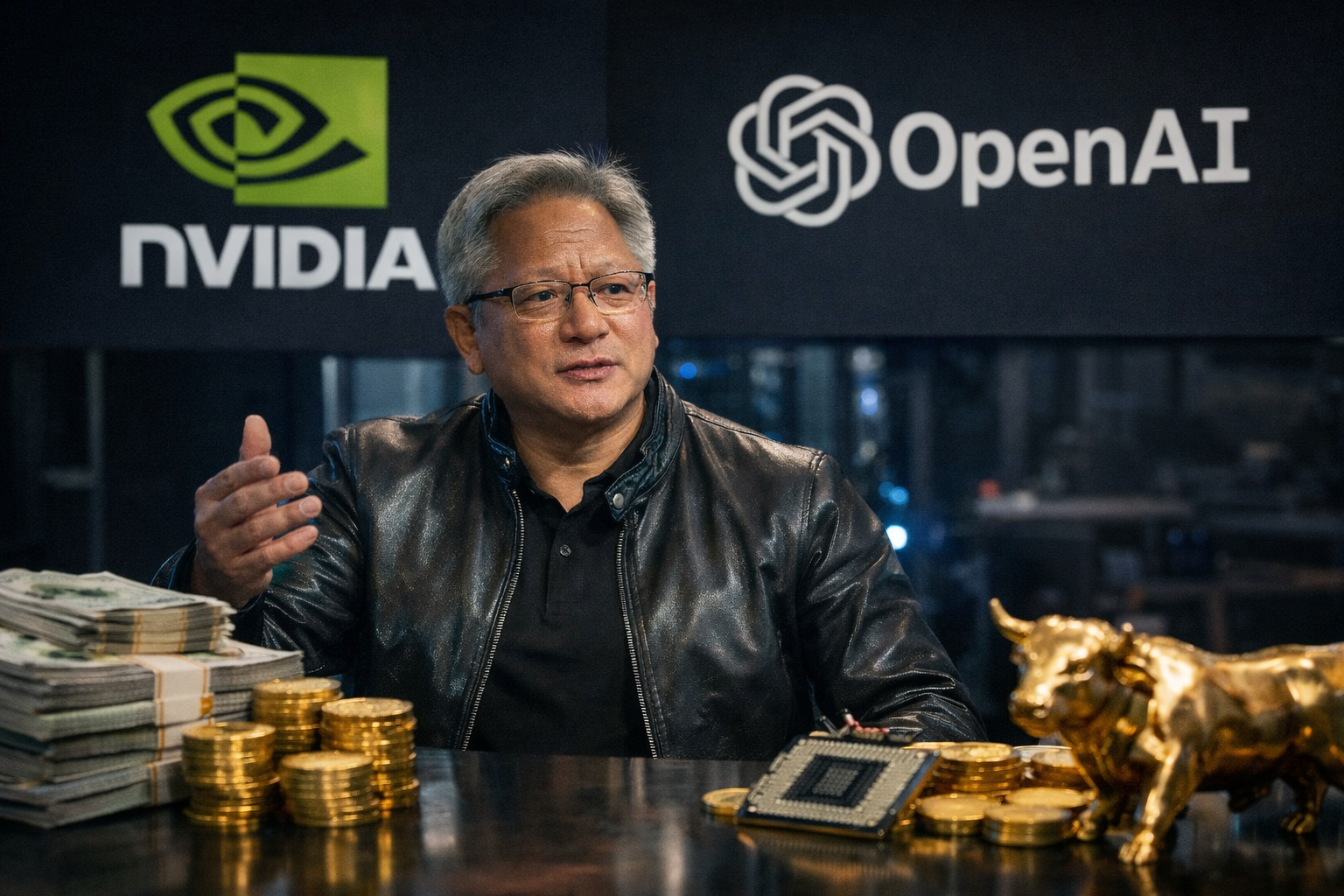

Nvidia to invest $20B in OpenAI even as its China chip sales stalled: report

Nvidia Corp. is nearing a deal to invest roughly $20 billion in OpenAI as part of the ChatGPT maker’s latest funding round, reported Bloomberg, citing people familiar with the matter, marking what would be the chipmaker’s single largest investment to date. The contribution is close to being completed, the sources said. The deal is not… Continue reading Nvidia to invest $20B in OpenAI even as its China chip sales stalled: report

Spire Healthcare shares surge 20% after confirming talks with buyout firms

Shares in Spire Healthcare surged as much as 20% on Monday after the private hospital operator confirmed it was in preliminary talks with several buyout firms, fuelling expectations of a potential takeover and delisting from the London Stock Exchange. The FTSE 250-listed group said Bridgepoint Advisers and Triton Investments Advisers were “amongst the parties” involved… Continue reading Spire Healthcare shares surge 20% after confirming talks with buyout firms

Synthesia raises $200M at $4B valuation with Nvidia, Alphabet among backers

British artificial intelligence company Synthesia has raised $200 million in a Series E funding round, valuing the business at $4 billion and underscoring continued investor appetite for niche AI companies with clear commercial use cases. The valuation nearly doubles the $2.1 billion level the London-based startup achieved last year. The latest round was led by… Continue reading Synthesia raises $200M at $4B valuation with Nvidia, Alphabet among backers

CVC Capital to buy Marathon Asset Management in $1.2B US credit push

Private equity firm CVC Capital has agreed to acquire 100% of US-based Marathon Asset Management in a transaction valued at up to $1.2 billion, marking a major expansion of its credit business in the United States. The Jersey-based firm said on Monday that the deal is expected to close in the third quarter of this… Continue reading CVC Capital to buy Marathon Asset Management in $1.2B US credit push

Alessio Vinassa on building trust in uncertain markets: a leadership imperative for the next decade

Uncertainty has become the defining condition of modern business. Market volatility, rapid technological shifts, geopolitical tension, and changing workforce expectations have made long-term predictability increasingly rare. In this environment, traditional competitive advantages—speed, scale, or capital—are no longer sufficient on their own. According to Alessio Vinassa, serial entrepreneur, advisor, and leadership mentor, one asset is emerging… Continue reading Alessio Vinassa on building trust in uncertain markets: a leadership imperative for the next decade

OpenAI seeks $50B funding round in Middle East at up to $830B valuation

OpenAI Chief Executive Officer Sam Altman has been meeting with major investors in the Middle East to line up funding for a massive new investment round that could total at least $50 billion, according to reports from Bloomberg and CNBC. The discussions underscore the scale of capital OpenAI is seeking as it races to build… Continue reading OpenAI seeks $50B funding round in Middle East at up to $830B valuation

Anthropic IPO news: AI giant to raise $25 billion as valuation soars

Anthropic, one of the top players in the artificial intelligence (AI) industry, is considering going public through an IPO later this year. It is also lining up a big capital raise before going public. Anthropic to raise funds ahead of its IPO This year will be a big one for the initial public offerings, with… Continue reading Anthropic IPO news: AI giant to raise $25 billion as valuation soars