Vanda Pharmaceuticals (NASDAQ: VNDA) opened some 45% higher today after the biotech firm said it has received the FDA’s approval for its treatment of schizophrenia and bipolar I disorder. The BYSANTI (milsaperidone) announcement is a welcome reprieve for VNDA that’s been under pressure this year as investors weighed “disappointing” Q4 earnings against a backdrop of… Continue reading Vanda stock’s explosive rally may be more hype than substance

stocktrader

Royal Bank of Canada stock double-tops ahead of Q1 earnings

Royal Bank of Canada stock has been in an unstoppable bull run in the past few years and is now hovering at its all-time high. It has soared by 160% in the last five years, beating JPMorgan, which has jumped by over 133% in the same period. So, will the rally accelerate as the company… Continue reading Royal Bank of Canada stock double-tops ahead of Q1 earnings

Almirall profit quadruples in 2025 as dermatology fuels growth push

Almirall, a pharmaceutical firm based in Spain, ended 2025 with a net profit of €46.2 million, which was 357% more than its 2024 profit of €10.1 million. The Barcelona-based pharmaceutical company was able to exceed the significant €1 billion sales threshold thanks to a 12.5% increase in revenue to €1.1145 billion. Following a more muted… Continue reading Almirall profit quadruples in 2025 as dermatology fuels growth push

US stocks open flat after Trump raises global tariffs to 15%

US equities were little changed on Monday after President Donald Trump announced an increase in global tariffs to 15%, following a Supreme Court ruling that struck down his earlier “reciprocal” tariff framework. The S&P 500 hovered around the flatline during the session, while the Dow Jones Industrial Average and the Nasdaq Composite also traded with… Continue reading US stocks open flat after Trump raises global tariffs to 15%

Eli Lilly bets on multi-dose Zepbound pen in GLP-1 retention push

Millions of people on GLP-1 weight-loss drugs know the weekly routine by heart: a new injector pen, a new box, another reminder to refill, and one more item for the sharps bin. Eli Lilly is trying to make that routine feel less like a chore. The company says it has launched a new Zepbound KwikPen… Continue reading Eli Lilly bets on multi-dose Zepbound pen in GLP-1 retention push

Merck creates separate oncology arm ahead of Keytruda patent loss

Merck said on Monday that it will split its human-health operations into two separate divisions, a move designed to sharpen focus across its portfolio and ensure smoother launches of new medicines. The move comes as the drugmaker seeks to prepare for mounting sales pressure later this decade, driven by the looming loss of exclusivity for… Continue reading Merck creates separate oncology arm ahead of Keytruda patent loss

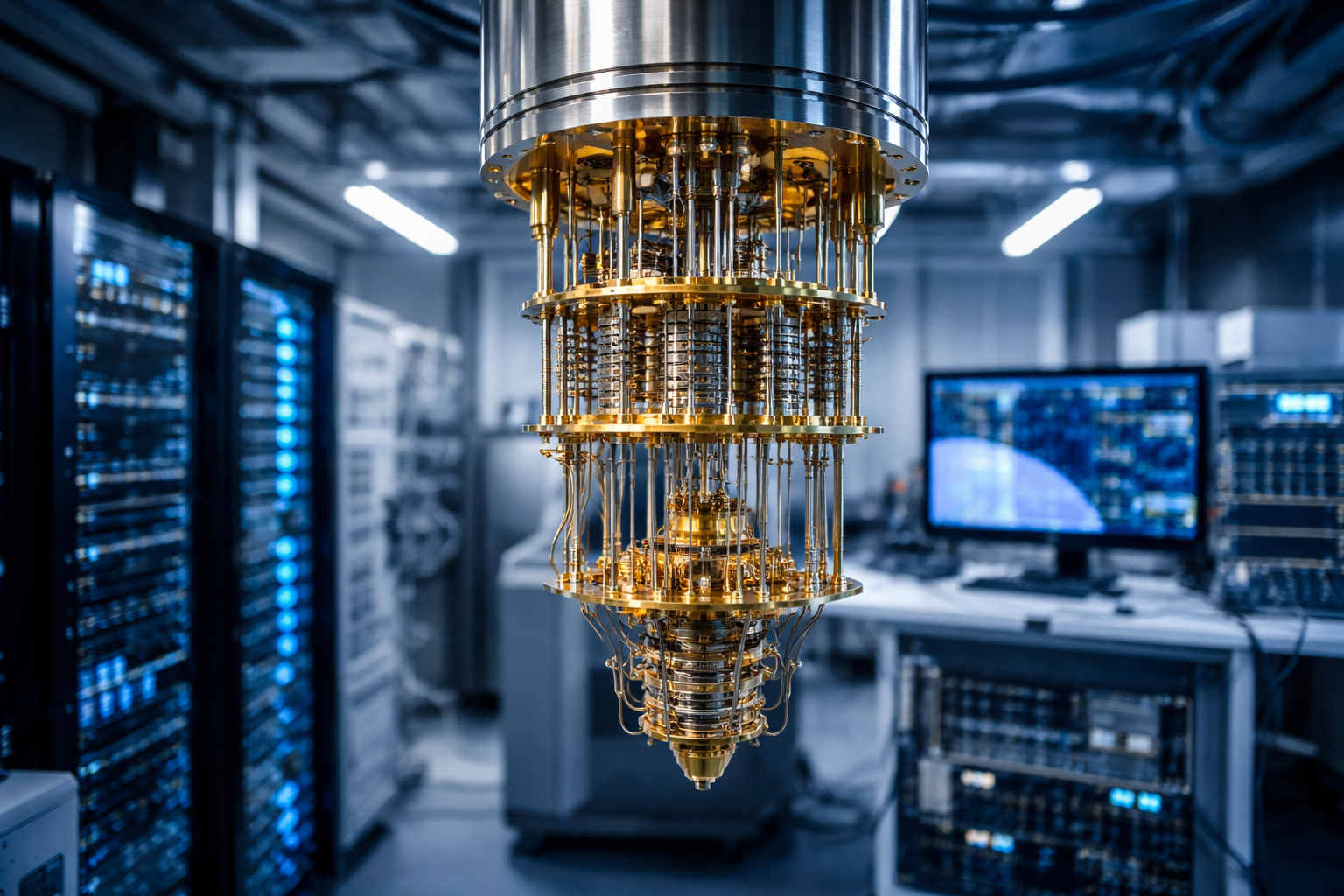

Finland’s IQM leads Europe’s quantum push with US listing plan

Finland’s IQM is positioning itself at the centre of Europe’s quantum technology ambitions as it prepares to enter public markets in the US. According to a CNBC report, the company said on Monday it plans to merge with Real Asset Acquisition Corp, a special purpose acquisition company, in a deal that would value IQM at… Continue reading Finland’s IQM leads Europe’s quantum push with US listing plan

Why is Arcellx stock up 80% today? Gilead’s $7.8B answer

Arcellx stock (NASDAQ: ACLX) climbed roughly 80% in premarket trade on Monday after Gilead Sciences agreed to buy the cancer-therapy developer in a $7.8 billion all-cash deal. The stock’s move wasn’t a mystery rally. The surge was a classic takeover repricing: once Gilead and Arcellx signed a definitive deal at $115 a share, traders quickly… Continue reading Why is Arcellx stock up 80% today? Gilead’s $7.8B answer

Citrini research: S&P 500 to drop 38% from 2026 highs by June 2028

In a sweeping and provocative macro-analysis titled “The 2028 Global Intelligence Crisis,” Citrini Research has outlined a sobering vision of a financial future where the very success of Artificial Intelligence becomes the primary engine of economic instability. The report, co-authored by Alap Shah, suggests that by June 2028, the global economy may be caught in… Continue reading Citrini research: S&P 500 to drop 38% from 2026 highs by June 2028