Private markets fundraising has seen a decline of over 10% in the last two years, but family offices and ultra-high-net-worth individuals (UHNWIs) are increasingly showing interest in the asset class.

While traditionally dominated by institutional investors like pensions and sovereign wealth funds, private markets are becoming a key focus for private wealth investors seeking diversification and the potential for higher returns, according to the ‘Private Markets Annual Report 2024’ by Barclays.

Average family office portfolio allocation to private markets increases

The past decade has seen the collective assets under management (AUM) of family offices more than double, making them a significant source of capital, as per the report.

The number of global private wealth owners is expected to increase by 28.1% by 2028, and top private equity (PE) firms are likely to benefit from this growing capital pool.

The report also included insights from Rob Fairbairn, vice chairman of BlackRock, who noted that the average family office portfolio allocates about 45% to private market investments today, and this is likely to increase over time, driven by factors such as potential returns, diversification, and access to opportunities.

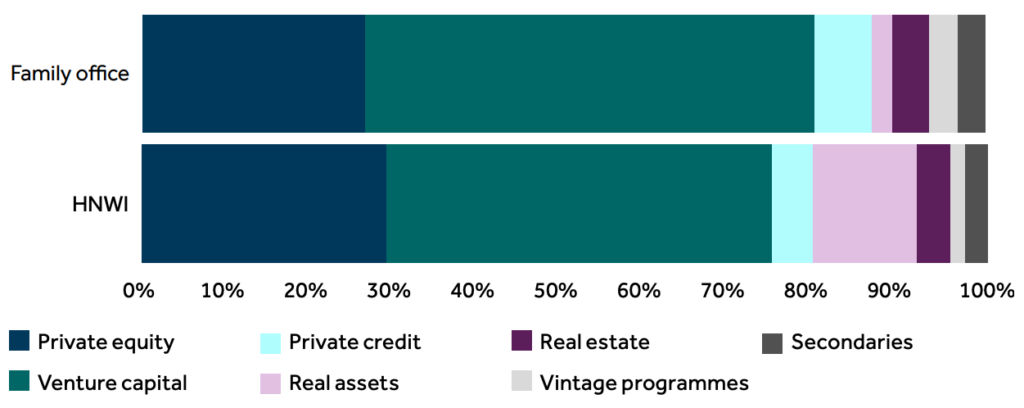

According to a 2023 survey by Campden Wealth and Titanbay, family offices and UHNW investors are increasingly turning to private equity for portfolio diversification.

Respondents indicated a 3% increase in their target allocation for PE, while also reducing their cash holdings.

The survey also revealed that 67% of respondents viewed private equity as a key strategy for enhancing long-term returns.

Share of global private wealth investor commitment count by asset class, Source: Barclays

Rob Kapito, president at BlackRock, points out in the report:

Family offices are increasingly institutionalising their approach to private markets, building in‑house specialised investment teams, adopting

comprehensive due diligence processes, implementing more formal governance structures and engaging more in direct investments

(rather than solely on funds), which allows them more control and alignment with specific investment objectives.

Within private equity, there is a strong focus on growth-stage companies and buyout opportunities, particularly in sectors like technology, healthcare and consumer.

Private equity secondaries are also popular, Kapito adds.

Benefits of private markets for private investors v/s institutional investors

Family offices and HNWIs are drawn to private markets due to several key factors such—historical outperformance compared to public markets, lower volatility, and higher leverage—all of which can drive stronger returns.

Unlike institutional investors, who must adhere to strict mandates, private wealth investors often have greater flexibility in their investment strategies.

They can tailor their allocations to match personal values and liquidity preferences, giving them more control over their portfolios.

Moreover, private investors are not bound by the same strict timelines as institutional investors.

This flexibility allows them to focus on longer-term investments without the need for regular incremental contributions or distributions.

As a result, private wealth investors are better positioned to navigate the illiquid nature of private markets, which often requires capital to be locked in for a decade or more.

As of 2022, global private wealth was estimated at between $140 trillion and $150 trillion, surpassing institutional capital by approximately $5 trillion.

Bain & Company project that individual wealth invested in alternatives will grow 12% annually over the next decade (2022–2032), compared

to 8% annually for institutional investors over the same period.

Allocations to alternative assets, such as private equity, are still higher among institutional investors. This highlights a considerable opportunity for collaboration between private wealth managers and asset managers.

However, private wealth investors do face regulatory hurdles when accessing private markets.

Many regions have qualification requirements, limiting participation to accredited investors with significant financial resources.

Role of private equities in driving private markets fundraising

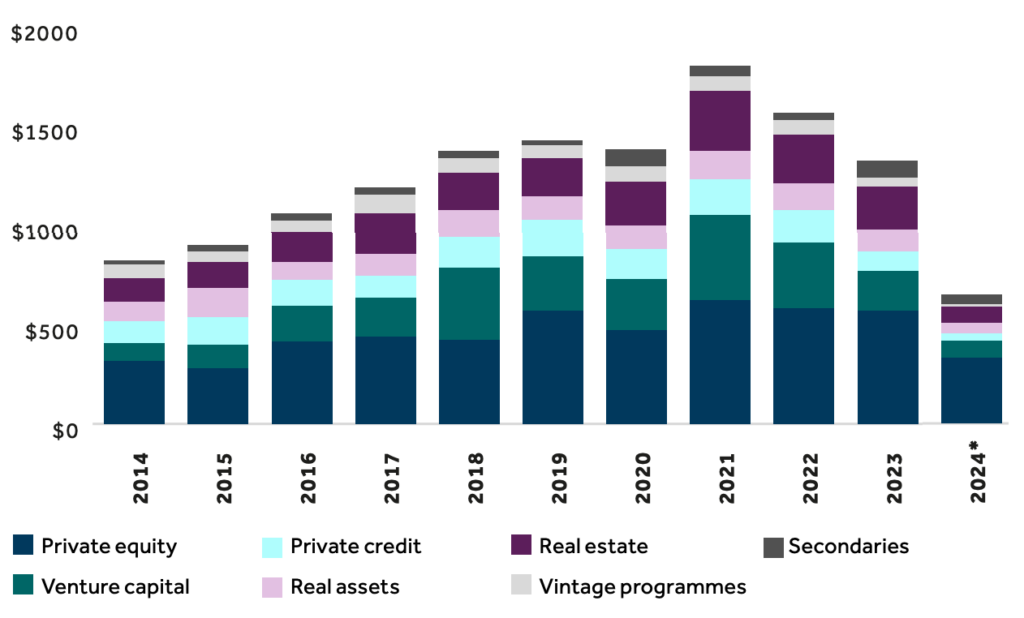

Despite the growing interest from family offices and private wealth investors, private markets fundraising has faced challenges.

Fundraising value has fallen by more than 10% over the past two years, and data for 2024 shows a continued slowdown.

However, the decline has not been as severe as some expected, and fundraising activity remains concentrated among a select few funds.

Despite the overall slowdown, private equity remains the largest driver of private markets fundraising.

In 2023, private equity accounted for more than 50% of total fundraising activity, underscoring its continued popularity among investors.

Global private markets capital raised ($ billion) by asset class. Source: Barclays

While the number of funds raising capital has decreased, the total amount raised in 2023 was nearly on par with the previous year.

This indicates that the sector’s stalwart funds continue to dominate, attracting the majority of capital commitments.

According to PitchBook, closed-end private markets funds held $14.7 trillion in AUM as of 2022, a figure projected to rise to $19.6 trillion by 2028.

The influx of private wealth into these markets could further accelerate this growth, as more family offices and wealthy individuals allocate capital to private equity and other alternative assets.

The 2023 Campden Wealth and Titanbay survey showed that 84% of UHNW individuals and their family offices were already investing in private equity, with an additional 10% expressing interest.

A word of caution for private wealth investors

As private markets continue to evolve, family offices and UHNWIs are poised to play an increasingly influential role.

Their growing interest in private equity, combined with the flexibility of private wealth strategies, positions them as a crucial source of capital in the years ahead.

There is a variety of different private channels that can help investors achieve their goals, though PE and VC are the leading drivers

of the increasing interest in private funds based on their strong long-term performance, network of opportunities, and sheer size reflected in

AUM figures.

“The existing preference for PE, VC and experienced managers is likely to continue in order to manage risk, but manager selection and

due diligence have become more active choices for many, and HNWIs and family offices must carefully consider the growing menu of options for their private markets investments,” the report adds.

The post Private investors seek larger share of private markets despite fundraising decline appeared first on Invezz