A significant shift in the way UK consumers handle their financial transactions has been observed, as one in three Britons made contactless payments via phone each month last year.

This change comes amid a continued decline in cash usage, signaling a transformation in consumer spending behaviour.

Rise of digital wallets and decline of cash

The findings of a report by trade body UK Finance and consultancy Accenture reveal a surge in the popularity of digital wallet services such as Apple Pay and Google Pay.

Enhanced security features and looser spending limits have contributed to this trend. In 2023, 34 percent of British consumers used mobile contactless payments at least once a month, a figure calculated for the first time.

The report also highlights a dramatic increase in the share of UK adults registered with a digital wallet, which rose to 42 percent in 2023 from 30 percent the previous year.

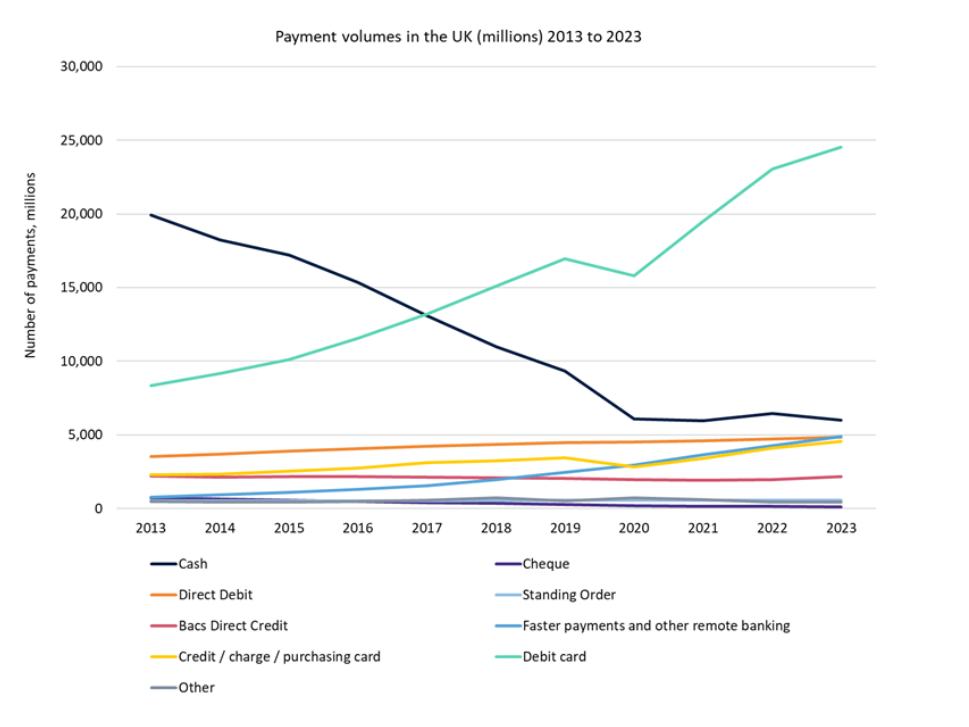

This surge in digital wallet adoption coincides with a decrease in cash transactions. In 2023, cash accounted for just 12 percent of all payments, down from 14 per cent in 2022.

The most common form of payment was chip-and-pin debit cards, which made up half of all payments, while contactless payments, both by card and mobile, comprised 38 per cent.

Sulabh Agarwal, global payments lead at Accenture, noted,

Just as credit and debit cards once offered consumers a more seamless option than cash or cheques, payment methods like digital wallets are quickly gaining market share.

Trends and regulatory scrutiny

The decline in physical money aligns with a long-term trend, although cash use saw a brief rise in 2022 as consumers sought to control spending amid rising living costs.

However, mobile payments have surged in popularity due to their biometric security features and the absence of the £100-per-payment limit imposed on contactless plastic cards.

This growth has caught the attention of financial watchdogs.

The Payment Systems Regulator (PSR) and the Financial Conduct Authority (FCA) have launched an investigation into the competitiveness of wallets provided by Apple, Google, and PayPal.

David Geale, PSR managing director, emphasized the need to understand the implications of digital wallets on competition, consumer protection, and market integrity.

Digital wallets are steadily becoming a go-to payment type and, while this presents exciting opportunities, there might be risks too.

Key figures for 2023

The total number of payments made in the UK increased by five percent to 48.1 billion. Of these, almost four out of ten (38 percent) were contactless. One-third of UK adults were using mobile contactless payments at least once a month.

The number of cash payments fell to six billion, representing 12 percent of all payments. Faster Payments overtook Direct Debit to become the third most used payment type in the UK in 2023.

Source: UK Finance

Consumers accounted for 85 percent of the total number of payments (41 billion), with businesses making up the remaining 15 percent (7.1 billion).

This shift suggests an increase in the number of transactions with lower individual values, possibly driven by more frequent shopping trips, hybrid working, the use of multiple bank accounts, and the rise of Buy Now Pay Later (BNPL) services.

Credit and debit cards remain dominant

Debit cards remained the most popular payment method, accounting for 51 percent of all payments in 2023.

Card volume increases were driven by a trend towards lower-value payments, particularly in consumer retail spending.

The migration from cash to cards continues, as does the trend of small businesses increasingly accepting card payments.

Deferred expenditure following the pandemic may still be affecting credit card spending, with people using credit for summer holidays, home renovations, and other big-ticket items not purchased during lockdowns.

Continued growth of contactless and mobile payments

Usage of contactless and mobile contactless payments continued to rise in 2023, with 18.3 billion contactless payments made in the UK, an increase of seven per cent from the previous year.

Contactless payments represented 38 per cent of all payments, including both physical cards and mobile devices.

The number of people registered for mobile contactless payments, such as Apple Pay and Google Pay, increased to 42 percent of the adult population, up from 30 per cent in 2022.

One-third (34 per cent) of adults used mobile contactless payments at least once a month in 2023.

Mobile contactless payments benefit from additional security features like biometric authorisation and do not have upper-value limits on individual payments.

Cash usage trends and remote banking

The volume of cash payments fell by seven per cent to six billion payments in 2023. Cash accounted for 12 percent of all payments, down from 14 percent in 2022.

Despite the decline, cash remains the second most frequently used payment method in the UK, varying slightly by age.

Almost four out of ten UK adults (39 percent) were living largely cashless lives during 2023. However, the number of people mainly using cash in 2023 rose to 2.6 percent of the population, up from 1.7 percent in 2022.

Remote banking remained popular, with 87 percent of adults using at least one form of remote banking in 2023.

Mobile banking usage increased from 53 percent to 60 percent, while online banking via computer fell from 65 percent to 62 percent, reflecting a shift towards mobile device banking.

Forecasts and future payment landscape

Over the next decade, debit card payment volumes are expected to continue increasing, driven by the rise of contactless payments, online shopping, and card acceptance among businesses.

Debit card payments are forecast to reach over 31 billion by 2033.

Cash payments are predicted to continue their long-term decline, although the rate of decline is expected to slow.

Researchers forecast around 3.4 billion cash payments in 2033, accounting for about six per cent of all payments.

Adrian Buckle, head of research at UK Finance, highlighted the diversity of payment options available to consumers.

He noted the continued popularity of debit cards and contactless payments, driven by consumer demand and new technologies that increase acceptance levels among small and mobile businesses.

There is a huge amount of choice available to consumers in terms of how they make payments, but we can definitely see the continued popularity of debit cards and contactless…This has been driven both by consumer demand as well as new technologies which help to increase acceptance levels, particularly among small and mobile businesses. Mobile contactless payments are growing fast and one third of adults are now making these at least once a month, with scope for usage to increase further.

The post One-third of UK adults now use mobile contactless payments appeared first on Invezz