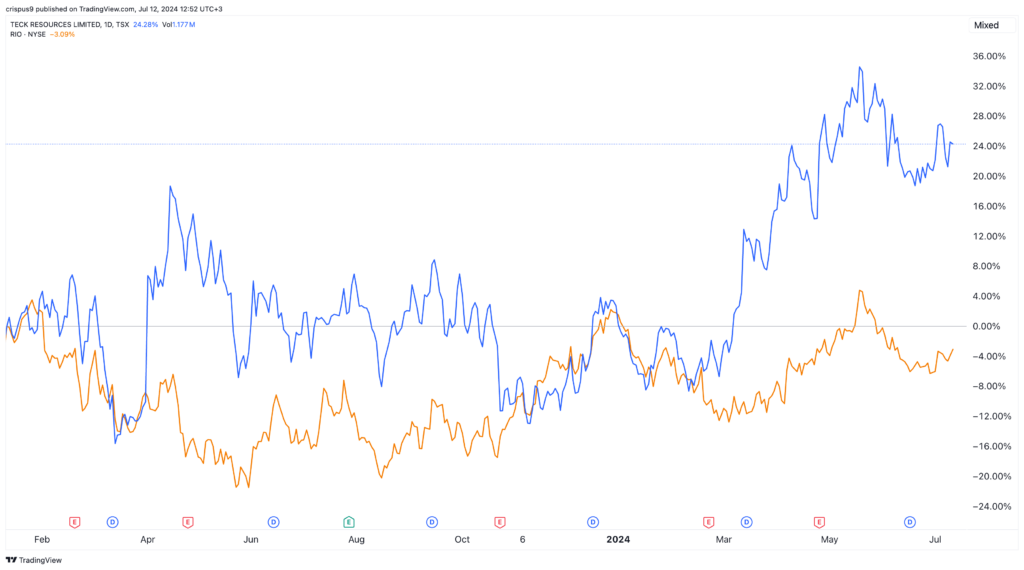

Teck Resources (TECK) stock price has done well in the past few years as it continued to beat key peers in the industry. It has jumped by over 24% this year, beating the iShares Copper and Metals Mining ETF (ICOP) and the SPDR S&P Metals & Mining ETF (XME).

Rio Tinto is exploring a buyout

Teck Resources stock will be in the spotlight on Friday after a report by Sky News said that Rio Tinto was considering a bid.

According to Sky, the buyout would value the company at over $32 billion, a big premium since the company was valued at over $25 billion on Thursday.

This buyout would come at a time when mining and metals company are in considering mergers and acquisitions as conditions change.

In December last year, Nippon Steel unveiled a deal to acquire US Steel for almost $15 billion. Most recently, BHP Group announced a deal to acquire Anglo American, a global giant worth over $40 billion.

BHP is said to be considering other deals in a bid to boost its market share in key sectors like copper.

A bid for Teck Resources would come a few months after the company turned down a similar plan by Glencore. Instead, the company agreed to sell its coal business to Glencore for $7 billion. Glencore is now expected to combine these coal assets and spin them out as an independent company.

Rio Tinto vs Teck Resources

Demand for copper and transition metals

Analysts believe that the M&A in the mining industry will likely continue in the coming years because of the changes in the sector.

A key issue is that governments, especially in western countries, are taking longer to approve mining projects, a process that is extremely expensive. For example, just recently, the American government blocked Alaska’s Ambler Road that would give a company access to copper and zinc resources.

Rio Tinto’s potential bid for Teck Resources would be because of its top products, which include copper and zinc. It is also available in stable countries like the United States, Peru, Canada, and Chile.

Recent data shows that copper has done well in the past few years. It has soared by over 30% from its lowest point in 2023. However, recently, it has moved into a correction as it dropped by over 12% from its highest point this year.

In the long term, analysts believe that copper price will rise sharply as demand rises. This demand will come from changes in the electricity grid as countries change their energy mix and from the transition to EVs.

Teck Resources recent earnings

The most recent results showed that Teck Resources revenue business faced headwinds in the first quarter. Its revenue rose to C$3.98 billion from $3.7 billion a year earlier. Notably, most of these gains were because of its coal business, which it has now exited.

Its adjusted EBITDA dropped to C$1.69 billion while its profit fell to C$343 million. This performance was in line with other mining companies. In the future, the company is expected to continue growing as copper and zinc prices jump.

Rio Tinto has enough resources to buy Teck Resources. It has a market cap of over $168 billion, meaning that it can do an all-stock deal easily. It also ended the last quarter with over $10.7 billion in cash and short-term investments.

Still, it is unclear whether Teck Resources will agree to a deal and whether the Canadian government will allow it. Such a deal must be approved by Norman Keevil, the controlling shareholder of a company that was started by his father.

The post Teck Resources stock in focus as Rio Tinto considers a bid appeared first on Invezz