What a difference can a few months make. The Siemens Energy (ENR) share price has moved from being the worst-performer in the DAX index in 2023 into the best-performing one this year. It has jumped by almost 150% this year and by 330% from its lowest point in 2023.

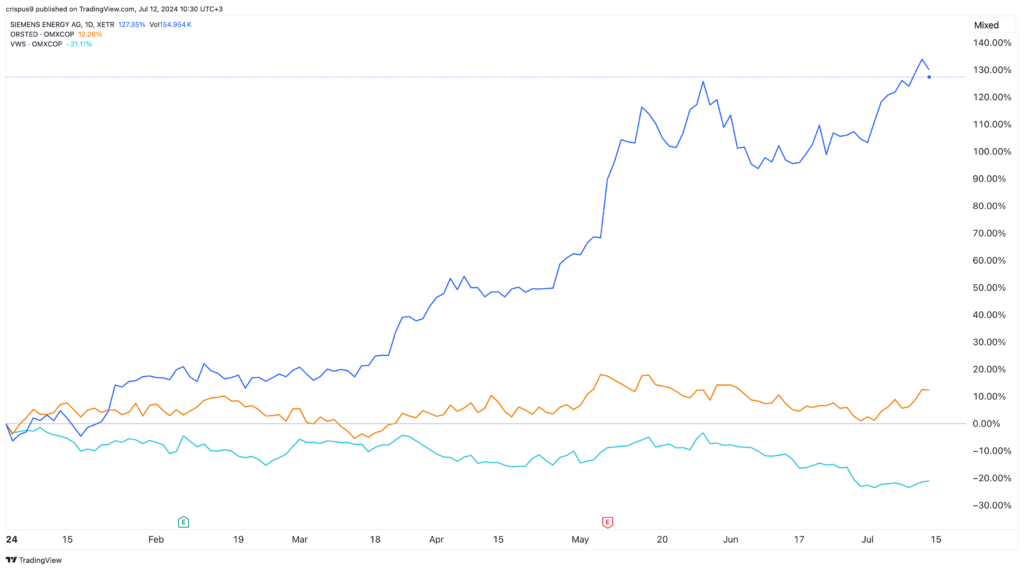

Siemens Energy has also beaten other wind energy companies like Orsted and Vestas Wind Systems, which have underperformed the market this year.

Siemens Energy vs Orsted vs Vestas Wind Systems

Siemens Energy almost collapsed in 2023

Siemens Energy is one of the biggest energy companies in Germany. It is a large firm that manufactures things like compressors, gas turbines, generators, and heat pumps.

It is also a major player in the renewable energy industry, where it manufactures wind turbines through its Siemens Gamesa business. It operates its services through several segments like Gas, Grid, Transformation of Industry, and Gamesa.

Siemens Energy was spun out of Siemens Group in 2020 and business has not been doing well since then. For one, Siemens Gamesa has suffered as the wind industry has slowed in the past few years because of high interest rates and low demand across all its segments.

The situation accelerated last year as problems in its Gamesa 4.X turbines led to major challenges. As a result, the company embarked on a costly repair problem that is estimated to cost over $4.5 billion in the long term.

As a result, Siemens Energy almost collapsed last year but was saved by Siemens Group and the German government, which sees it as a national champion.

The government provided its Gamesa unit with loan guarantees worth over €7.5 billion or $8.1 billion. Siemens Group and other stakeholders also provided the balance of the €15 billion bailout, a substantial figure for a company that was then valued at less than €10 billion.

Siemens Energy turnaround is continuing

Siemens Energy’s management has embarked on an extensive turnaround strategy as it seeks to become a profitable company. For example, it recently announced a plan to lay off 4,100 employees from the Gamesa unit, a move that is intended to save millions of euros each year.

There are signs that these turnaround efforts are starting to bear fruit. In May, the company said that its profit before special items rose to €170 million in the second quarter. This profit was mostly because of currency movements and sale of businesses.

It also raised its forward guidance for the year with its revenue growth expected to be between 10% and 12%. Before that, its guidance was a 3%-7% revenue growth. Its profit margin is expected to come in at between -1% and 1%. Also, its free cash flow will be about €1 billion.

Still, there are risks to its business. For example, while Siemens Gamesa’s wind turbines are popular, it is unclear whether the industry will recover this year. Also, the company is facing major competition from Vestas Wind Systems and other Chinese companies.

Siemens Energy share price analysis

Turning to the weekly chart, we see that the Siemens Energy stock price has bounced back in the past few months. This rebound is in line with what Nicholas Green of Bernstein predicted last year.

Most recently, the stock has risen for five straight weeks and has crossed the important resistance point at €27, its highest point on May 27th. Moving above that level is crucial since it has invalidated the double-top pattern that has been forming.

The Siemens Energy share price has also jumped above the 61.8% retracement point and the 50-week moving average. Therefore, there is a possibility that the stock will continue rising as buyers target the key resistance at €30.

The post Siemens Energy stock move from worst to best in Germany appeared first on Invezz