European equities tumbled yesterday as uncertainty dominates financial markets. With the debt ceiling deadline in the United States approaching fast, the bearishness of the US indices affects global equity markets.

Diversification is key when building a portfolio. Several ways to diversify exist, and one is to diversify with other countries’ equities.

As such, the Spanish equity market looks interesting for those interested in European equities other than German or French.

Its flagship index, IBEX 35, represents the performance of the largest securities traded on the Spanish stock market.

Top 10 IBEX 35 components

As the name suggests, IBEX 35 has 35 components from various industries, with the top 10 listed below:

- Iberdrola (BME:IBE)

- Inditex (BME:ITX)

- Santander (BME:SAN)

- BBVA (BME:BBVA)

- Caixabank (BME:CABK)

- Amadeus (BME:AMS)

- Cellnex (BME:AMS)

- Telefonica (BME:TEF)

- Ferrovial (BME:FER)

- Repsol (BME:REP)

The financial services sector dominates the index, followed by oil and energy, technology and telecommunications, and consumer goods.

IBEX 35 performance

The index is correlated with the equity markets in developed countries. As with equities in many developed economies, they lagged behind the bullishness of the US equity market seen in the last few years, especially during the COVID-19 pandemic.

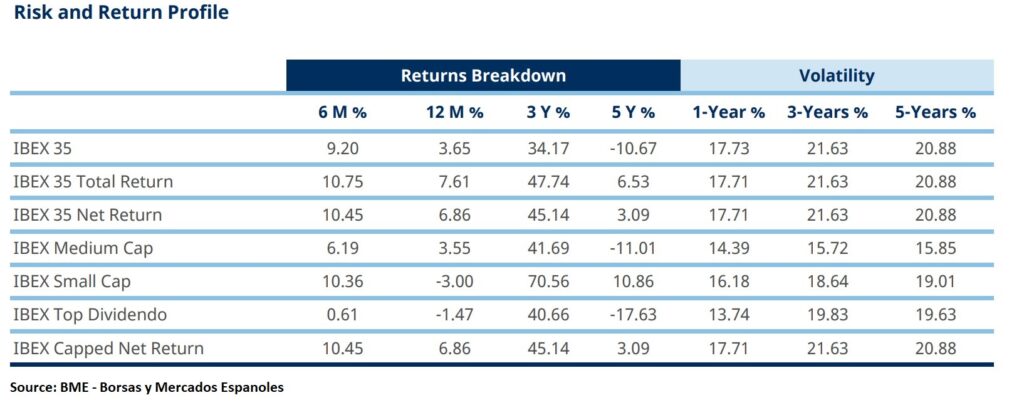

In any case, IBEX-35 has performed well, especially if we look at the total return (i.e., including dividends).

IBEX 35 technical analysis update – May 2023

IBEX 35 continued this year its bullish trend that started in the last part of 2022. It regained the 9000 points levels, but in doing so, it succeeded in breaking a major bearish trendline.

The bullish breakout is even more important because of the price action that followed. More precisely, the market retested the trendline after the breakout, as it has done so many times.

The retest confirms the bullish breakout, and now the attention turns to the pivotal 10,000 points level.

IBEX 35 failed at it in early 2020, just before the pandemic, and it has yet to overcome it. However, given the bullish breakout, one should not be surprised to see the leading Spanish stock market index trading above 10,000 points sooner rather than later.

The post IBEX 35 price forecast after yesterday’s red day for European equities appeared first on Invezz.