Which is the best-performing stock index in the world? Most people would cite American indices like the Nasdaq 100 and S&P 500 as the best performers. Sure, these indices have done well over the years. However, the Nifty 50 index has been the best-performing index in the past few decades by far.

Nifty 50 index vs American peers

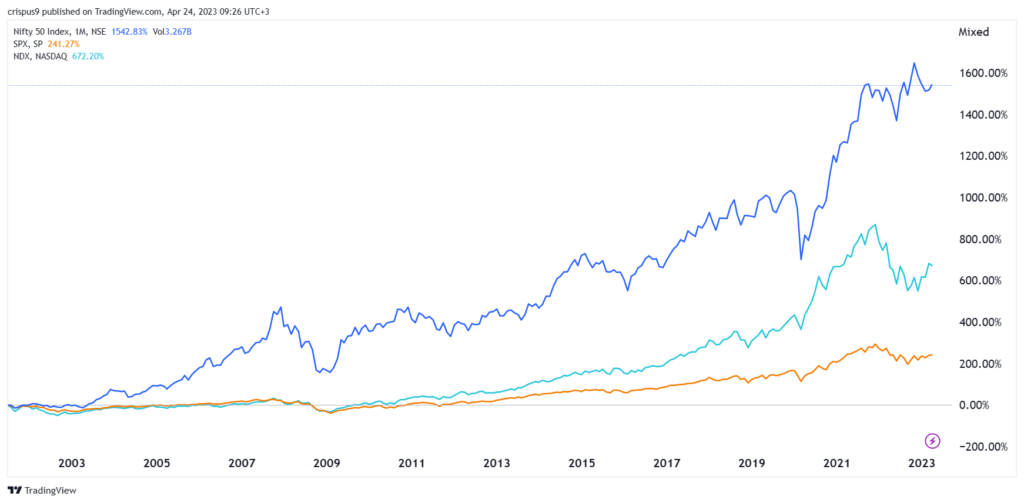

Contrary to the popular belief, India has been a bigger creator of wealth than many countries, including the United States. As shown below, the Nifty 50 index has surged by 1,493% since 2,000, making it one of the best-performing global indices.

In contrast, the S&P 500 index has jumped by just 246% in the same period while the Nasdaq 100 index has risen by about 700%. This means that Indian investors have grown their wealth at a faster pace than those in the USA.

The same trend has happened in the past few years. In the past 12 months, the Nifty 50 index has jumped by 4% while the Nasdaq 100 and S&P 500 index are still in the negative area.

It is worth noting that the dollar returns of Indian investors have been a bit smaller since the Indian rupee has dropped by about 87% since 2,000. Also, historically, India has had a higher inflation rate than the United States. The combination of higher inflation and weaker Indian rupee means that the real returns have been a bit smaller.

India billionaires rise

India has also continued producing billionaires in the past few years as the Nifty 50 and Sensex indices have soared. According to Forbes, India has 169 billionaires who are worth a combined $675 billion. The US has 735 billionaires while China has 562 billionaires.

Indin stocks have done well as the country has attracted more capital in the past few years. The best-performing Nifty 50 index companies in the past 3 years were Adani Enterprises, Tata Motors, JSW Steel, Tata Steel, Mahindra & Mahindra, and Apollo Hospitals Enterprises. All these shares have jumped by more than 225% in this period.

It is unclear whether Indian stocks will continue to outperform their global peers. A potential catalyst for this growth will be the ongoing foreign direct investments in the country. Companies are moving from China to India as tensions with the United States rises. However, the recent concerns about Adani’s companies could deter some investments in India’s companies. As I wrote here, Hindenburg Research said that the company was manipulating its stock using offshore firms.

The post Nifty 50 index vs S&P 500, Nasdaq 100: one clear winner in 2 decades appeared first on Invezz.