Coinbase (NASDAQ: COIN) stock price has done well this year, helped by the strong crypto comeback. It rose to a multi-month high of $85.42 earlier this year, which was ~178% above the lowest level in 2022. The shares were trading at $70 on Wednesday, giving it a market cap of over $15 billion.

Coinbase is a good company

Coinbase has emerged as one of the best companies in the crypto industry. For one, unlike Coinbase, it is a wholly American company that is supervised by the Securities and Exchange Commission (SEC). It is also the biggest publicly-traded company in the world, meaning that its books are audited by Deloitte, one of the largest audit companies.

Therefore, Coinbase, unlike its rivals, must disclose key information about its business. For example, it is mandated by law to declare its financial results every quarter. And these results must be accurate. Most exchanges don’t have to do all this because they are privately owned.

These regulations also explain why Coinbase is trusted by institutional investors in the US. Recent reports showed that institutional funds under custody have remained steady in the past few quarters. As cryptocurrencies show their resilience, there is a likelihood that Coinbase will benefit from institutional fund inflows.

Invest in Bitcoin itself

While Coinbase is a good company, you should avoid it as an investment. Instead, you should invest in Bitcoin itself.

If you are bullish on Coinbase stock, it means that you also have a positive opinion about Bitcoin itself. It is almost impossible to be bullish on Coinbase if you believe that Bitcoin is going to zero,

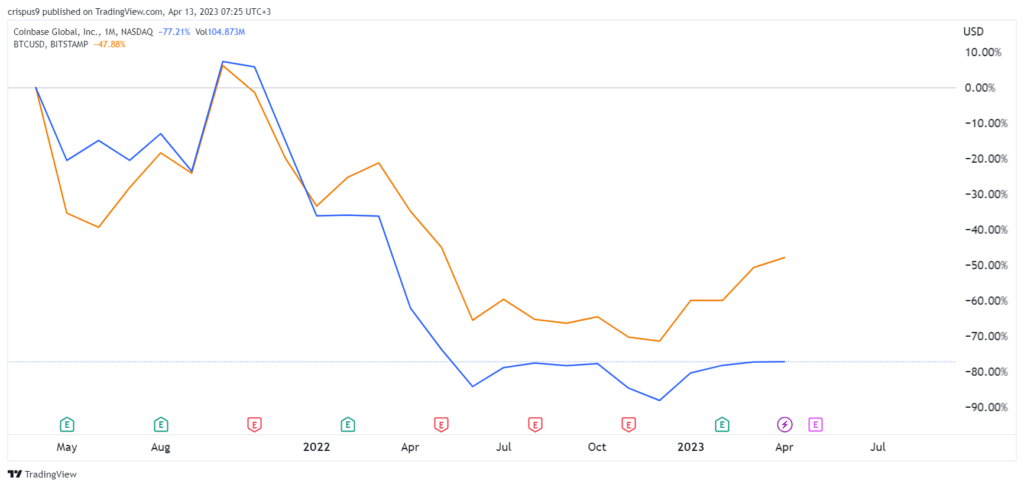

There are three main reasons why investing in Bitcoin is better than buying Coinbase stock. First, history shows that Bitcoin outperforms COIN. As shown below, Coinbase stock price has dropped by 80% since going public. In the same period, Bitcoin price has dropped by 48%.

Second, Bitcoin is not under regulatory scrutiny. The SEC and the CFTC both agree that Bitcoin is a unique product that is not a security. Instead, these agencies have focused their crackdown on Coinbase and other exchanges like Binance US and Kraken. Bitcoin is largely immune from these measures.

Finally, Bitcoin can exist well without Coinbase but vice versa is not possible. BTC has thrived even after the collapse of well-known platforms like Mt.Gox and FTX. This is a sign that the coin is resilient. It is hard to imagine Coinbase existence without Bitcoin.

Further, Bitcoin does not report quarterly results and is highly decentralized. In most cases, we often see good stocks plunge after publishing their quarterly results. Bitcoin is immune from these volatile situations. I also recommend buying BTC instead of mining companies like Riot Platform, Marathon Digital, and Argo Blockchain.

Watch here: https://www.youtube.com/embed/myRBIx3jYdM?feature=oembed

The post Avoid Coinbase stock and buy this instead appeared first on Invezz.