The SCHD ETF stock price has made a spectacular recovery in the past two weeks as the American banking crisis eased. The Schwab US Dividend Equity ETF, which is a $46 billion behemoth, has rebounded by ~5.50% from the lowest level in March and is trading at the highest level since March 9 of this year.

Gold star-rated ETF

Investing in good quality dividend stocks is one of the best approaches to accumulating wealth in the long term. When done well, it can lead to superior results than other investments. However, selecting single dividend stocks can be risky, as we saw when blue chips like AT&T and General Electric slashed their dividends.

Therefore, investing in a well-diversified, low-cost, and stable dividend ETF can be a good option. Fortunately, there are many such ETFs, including the Vanguard High Dividend Yield Index Fund (VYM), SPDR S&P Dividend ETF (SDY), and iShares Core High Dividend ETF (HDV). In most periods, these ETFs tend to move in sync with each other.

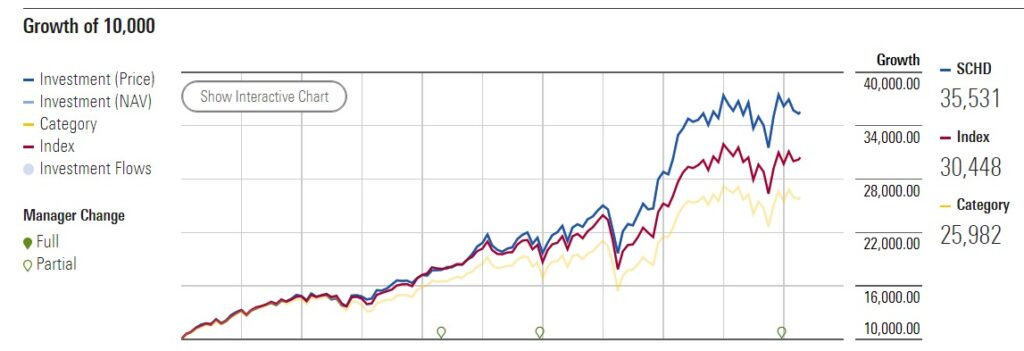

The Schwab US Dividend Equity ETF is my best dividend ETFs. For one, in the past decade, the fund has severely outperformed its peer funds. As shown below, $10,000 invested in the fund in 2013 is now worth $35,531. A similar amount invested in its peer funds is worth $25,982, which explains why it has a gold star rating by Morningstar.

SCHD has all the qualities you should look for in a dividend ETF. For one, it is a diversified fund with companies in all sectors. Industrials, health care, financials, consumer defensive, and technology have the biggest share of the fund. They are followed by energy, consumer cyclical, and communication.

The biggest holdings in the fund are AbbVie, PepsiCo, Verizon, and Amgen among others. In all, the top-ten companies represent 41% of the fund.

Is the SCHD stock a good buy?

There are reasons to be optimistic about the SCHD ETF, now that it has dropped by 8% from its highest point in 2022. First, historically, the fund has done better than other dividend ETFs, including the Proshares S&P 500 Dividend Aristocrats ETF (NOBL). NOBL is an important fund that tracks companies that have raised dividends in at least 25 years.

Second, SCHD ETF has a higher forward dividend yield and a faster dividend growth rate than all comparable funds that I described above.

Most importantly, macro conditions are impressive considering that the Fed is expected to pause its rate hikes after the next increase in May. Some analysts expect that the bank will start cutting interest rates in either Q4 of this year or in 2023. Therefore, a change of tune by the Fed will likely be an incentive for the return of the raging bull.

Watch here: https://www.youtube.com/embed/YT5rTY-QsZs?feature=oembed

SCHD ETF stock price analysis

Technical analysis can help us know whether to buy a good stock now or wait for it to drop further. Turning to the weekly chart, we see that the SCHD stock has been in a tight range recently. The shares have found a strong slanting resistance that is shown in red. It appears like it has formed a slanting double-top pattern whose neckline is at $65.90. The fund is also hovering at the 50-day and 100-day exponential moving averages.

Therefore, while the fundamentals are supportive, I would recommend waiting for a while to see if it will rise above the slanting trendline. The return of the raging bull will be confirmed if it moves above that level, which is ~79.05. This is in line with what I wrote in this article when I predicted that it would drop to $72, which it did.

The post SCHD ETF stock: is the return of the raging bull in sight? appeared first on Invezz.