The Rolls-Royce (LON: RR) share price has moved sideways as the recent comeback fades. The stock was trading at 147.3p on Monday, a few points below the year-to-date high of 159.45p. It has jumped by more than 126% above last year’s low of 65.06p.

Civil aviation recovery

Rolls-Royce has been one of the top-performing companies in the FTSE 100 index as investors anticipate a rebound in the civil aviation industry. Recent data shows that the civil aviation business has recovered in the past few months. This recovery has happened in all regions, including Asia, Europe, and North America.

Civil aviation is an important part of Rolls-Royce Holdings since it accounts for over 50% of its total revenue. In fact, plane manufacturers like Boeing and Airbus have all received tens of orders from companies like United, Delta, Saudia, and American.

Another catalyst for the Rolls-Royce stock is that the US dollar index (DXY) has declined in the past few months. The DXY was trading at $102 on Tuesday, sharply lower than its last year’s high of $115. The greenback has dropped by more than 15% against the British pound.

To a large extent, Rolls-Royce shares do well in a period of a strong US dollar since it generates a substantial amount of money from the US. As such, the company benefits when these funds are repatriated to the UK.

Industrial metal prices retreat

However, the weaker US dollar has coincided with low commodity prices. For example, steel price has dropped sharply in the past few months. Data by Argus shows that the spot price of iron ore has dropped to $118.80, the lowest point since January 9.

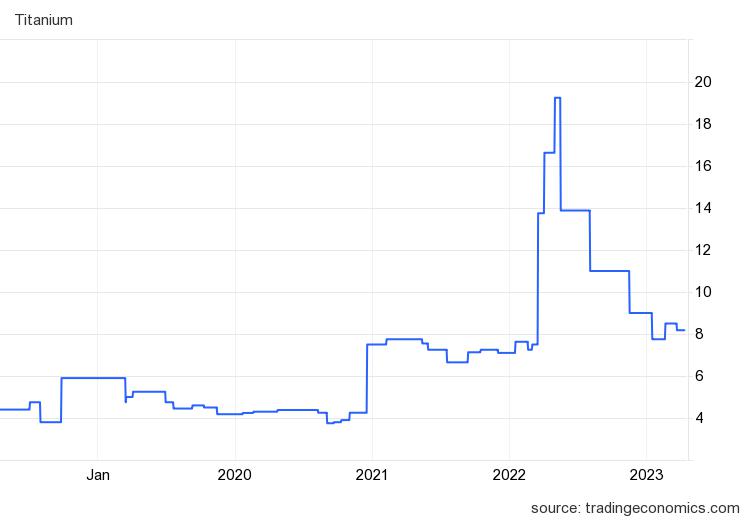

Similarly, as shown below, despite the ongoing war in Ukraine, titanium price have crashed to the lowest point since March last year. The same is true for other commodities that Rolls-Royce uses in its operations.

The falling commodity prices coincide with a period when the new CEO is working to cut costs and boost profitability. He has already ended some of the company’s unprofitable ventures such as its artificial intelligence unit. There is also a possibility that he will cancel the company’s green projects. When replacing the CFO, the company’s CEO said this about the new one:

“Track record of promoting rigorous financial discipline and experience of delivering performance management to achieve dramatic improvements will be invaluable as we move, at pace, to transform Rolls-Royce”.

Therefore, Rolls-Royce is seeing more demand for its services while the overall commodity costs are easing.

Rolls-Royce share price forecast

I have been bullish on Rolls-Royce stock in the past few months as you can read here, here, and here. On the weekly chart, we see that the stock has moved above the 23.6% Fibonacci Retracement level. It has also jumped above the 50-week moving average.

The stock has also formed a cup and handle pattern that is shown in green. In price action analysis, this pattern is usually a bullish sign. The current consolidation is part of the handle section.

Therefore, I suspect that the shares will have a bullish breakout in the coming days as buyers target the 50% Fibonacci level at 207p. This price is ~40% above the current level.

The post As the Rolls-Royce share price stalls, is it a buy or a value trap? appeared first on Invezz.