Pacific Biosciences of California Inc (NASDAQ: PACB) is trading meaningfully up on Friday after a TD Cowen analyst turned super bullish on the biotechnology company.

Pacific Biosciences stock has upside to $15

Dan Brennan now rates the said biotech stock at “outperform”. He raised his price objective on it to $15 today that suggests more than a 50% upside versus its previous close.

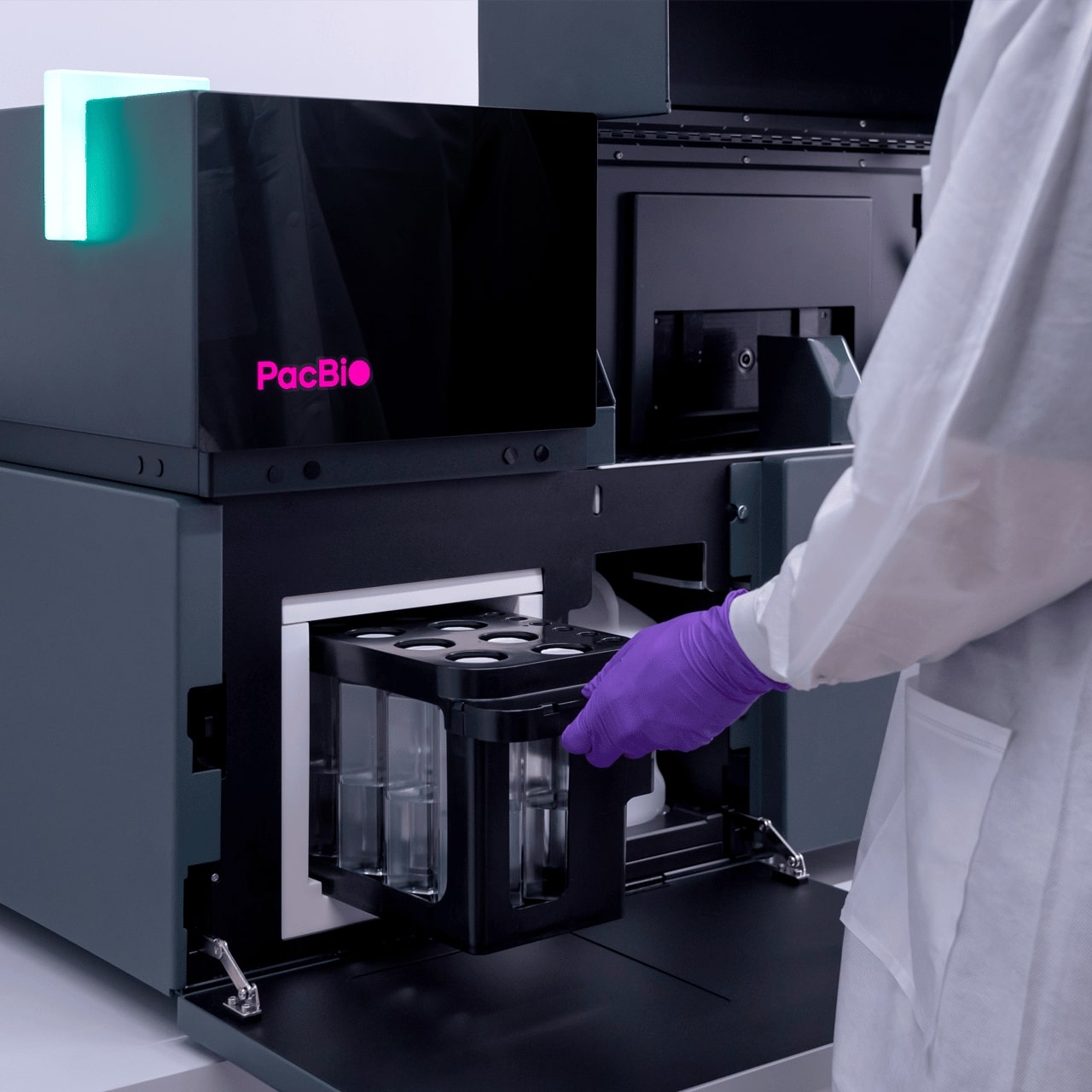

The analyst is bullish primarily on Revio – a system Pacific Biosciences launched in 2022 for sequencing whole human genomes.

If PACB can drive adoption of fits Revio platform and penetrate new end markets with long-read, we have little doubt the system will see meaningful uptake and drive a compounding inflection in revenue growth.

In February, the biotech firm reported better-than-expected revenue for its fiscal fourth quarter. Year-to-date, Pacific Biosciences stock is up more than 40% at writing.

Why else is he bullish on this biotech stock?

Revio is a promising tool for human genetics and cancer research. The launch of its ultra-high throughput version scheduled for later, Brennan wrote, could also be a notable catalyst for Pacific Biosciences stock.

Earlier this week, the Nasdaq-listed firm said it developed new workflows with Corteva Agriscience for high throughput plant and microbial genome sequencing. The TD Cowen analyst added:

Our bullish customer survey reflects upside to placements and pull through, along with a material budget shift to long reads. PACB is a growth transformation story and we think it’s time to get on board this multi-year story.

All in all, Brennan sees a 6.0% upside to 2023 consensus – sufficient for him to be constructive on this biotech stock.

The post Biotech stock Pacific Biosciences could return 50% in 12 months: TD Cowen appeared first on Invezz.