Analysts at crypto market data provider Kaiko say the crypto market has experienced a “fair share of liquidity incidents this month.” In their opinion, even though data shows liquidity in crypto has bounced to levels seen in early March, the situation could get a lot worse in the long term.

The impact of recent collapses of Silicon Valley Bank and Signature Bank may present a gap in payment networks, Kaiko’s Cody Ryder wrote. This could in turn eat into market maker confidence for US providers, affecting liquidity and fresh adoption of crypto as an asset class,

Low liquidity, more volatility for crypto

As Kaiko researcher Conor Ryder explains in a report shared with Invezz, cryptocurrencies experience the most volatility when liquidity – the ease at which investors can access and readily convert assets into cash without impacting the asset’s market price – is low.

Simply, when liquidity is low, prices often lack any robust support and can witness extreme movement to the downside or the upside.

For instance, Bitcoin (BTC/USD) just had one of its biggest weeks in 2023 with prices trading to near $29,000. But the crypto market also saw BTC fall sharply from around $28,765 to the $26,700 region. The dip come as cryptocurrencies mirrored stocks, with investors’ reaction across traditional financial markets to the latest FOMC decision reflecting negative sentiment towards the Fed’s 2% target.

What’s the state of liquidity in crypto markets?

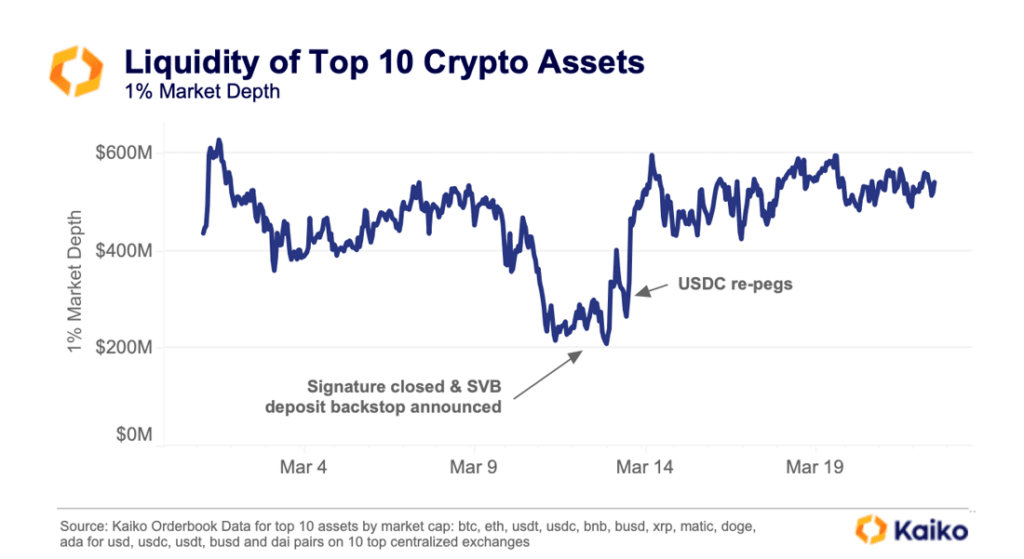

The absence of liquidity has been evident in crypto for a while, with the latest fueled by the contagion from the traditional financial markets. To exemplify the “worsening” situation, Kaiko examined four key metrics – market depth, spreads, volumes and slippage. There is some positivity yes, but the overall outlook underscores the current state of liquidity across the cryptocurrency market.

In early March, the crypto market saw a $200 million dip in market depth as Silvergate’s issues surfaced and the crypto-bank moved to halt its SEN network. Silicon Valley Bank and Signature Banks then collapsed, impacting market makers around USD settlements and adding to the liquidity concerns in crypto.

Ryder notes in the report:

“The closure of SEN and wind-down of Signet, some of the only USD payment rails for crypto, resulted in U.S exchanges being harder hit from a liquidity standpoint as market makers in the region face unprecedented challenges to their operations.”

While data shows liquidity of top 10 assets has returned to early-March levels, Bitcoin’s remains near its 10-month lows and the impact of the collapsing fiat on-ramps might present further issues down the road. Despite an increased adoption of stablecoin pairs as USD pairs are phased out, a lack of new payment networks replacing SEN or Signet could worsen the liquidity situation.

To boost confidence in market makers and help attract more liquidity to the market, Ryder says the market needs a new player to fill the USD payment rail gap. This could mean further improvement to liquidity and less volatility, which will only increase crypto’s attractiveness as an asset class to more investors.

The crypto market needs this to happen to help kickstart the next bull cycle,, the analyst noted.

The post Kaiko: Liquidity situation in crypto “worsening” amid USD payment rails issue appeared first on Invezz.